Mistakes in the Social Security earnings record are actually fairly common. Your Social Security benefits are based on your highest 35 years of earnings history. So, if your earnings for any particular year are underreported, it will reduce your benefits.

These errors typically occur because your employer either reported your earnings incorrectly or reported your earnings using the wrong name or Social Security number. Or if you got married or divorced and changed your name but did not report the change to Social Security.

Check Your Statement

The best way to keep an eye on your benefits and avoid any possible mistakes is to carefully review your Social Security statement every year. To do this, go to SSA.gov/myaccount and then print your statement out on paper.

If you’re age 60 or older and not yet receiving benefits and don’t have a My Social Security account online, your statement will actually be mailed to you about three months before your birthday.

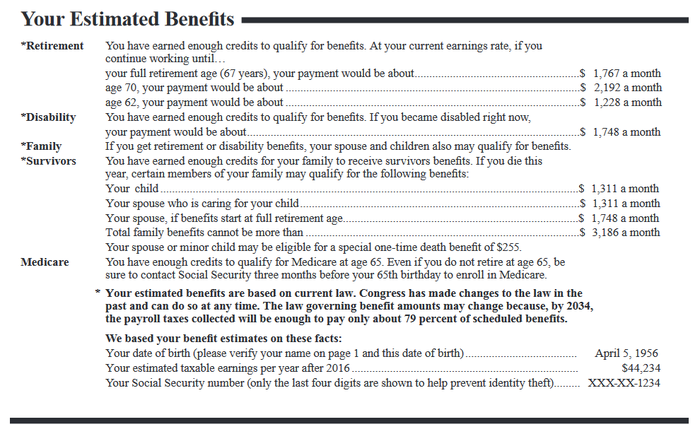

Your Social Security statement lists your earnings record for each year of employment and estimates the benefits you and your family may receive as a result of those earnings.

Once you get your statement, take some time to verify its accuracy by comparing the earnings listed on your statement with your own tax records or W-2 statements. You have to correct errors within 3 years, 3 months and 15 days following the year of the mistake. If you happen to spot a discrepancy within that time limit, follow these steps.

First, call your nearest Social Security office (see SSA.gov/locator or call 800-772-1213 to get the number) to report the error. Some corrections can be made over the phone, or you may need to schedule an appointment and go in with copies of your W-2 forms or tax returns to prove the mistake, or you can mail it in.

If you suspect a discrepancy but don’t have backup records, the Social Security Administration (SSA) may be able to use your employment information to search its records and correct mistakes. If the SSA can’t locate your records, you’ll need to contact the employer to obtain a copy of your W-2 for the year in question.

Once your earnings record is corrected, Social Security will send you a confirming letter. If you don’t receive the confirmation within three months, contact them again, and double-check the correction by making sure it appears on your Social Security statement.

If corrections aren’t made on your statement start an appeals process (see SSA.gov/pubs/EN-05-10041.pdf).

Other Mistakes

Social Security earnings miscalculations can also happen if there’s a mistake in your current mailing address that the IRS has on file for you. Check your federal tax returns for this possible error, especially if you’ve moved recently.

To correct your address, contact the IRS at 800-829-3676 and ask them to mail you the “Change of Address” form 8822, or print it off at IRS.gov/pub/irs-pdf/f8822.pdf, fill it out and mail it back to the address on the form.

Other factors that can cause mistakes are if your name or date of birth in the SSA records isn’t the same as it appears in the IRS files. So double-check your Social Security statement for these possible mishaps, and if you find an error call the 800-772-1213 and ask for Form SS-5, “Application for a Social Security Card,” and submit it with the correct information. The form can also be downloaded at SSA.gov/forms/ss-5.pdf.

Related Articles & Free Subscription

Related Articles & Free Subscription

How a Government Pension Might Reduce Your Social Security Benefits

How to Protect Yourself from the Social Security Imposter Scam

IRS Introduces a Tax Form Created for Older Taxpayers

Free Subscription to Vermont Maturity Magazine

Comment here