Retirement doesn’t affect your credit scores directly, but how you manage your finances during retirement can impact your credit and borrowing power.

Does Retirement Show on Your Credit Report?

Credit reports used to calculate your scores do not contain any information about employment status or income level. (Likewise, credit reports contain no information about your age, marital status, ethnicity, religion or race.)

What your credit reports do track is your personal history of borrowing and repaying money, including loans and credit card accounts. Credit reports reflect your history of making payments on loans and accounts that have been active in the past 10 years, even if the loans are now paid off in full or the accounts have been closed. They also record major negative financial events including foreclosures, repossessions and bankruptcies. These entries in your credit report are the raw material credit scoring systems analyze to generate your credit scores.

Retirement Can Affect Your Borrowing Power

While your credit scores won’t change just because you retire, your ability to borrow money could decline somewhat because your income is likely to drop at least incrementally as you shift from collecting paychecks to drawing Social Security and tapping retirement savings.

Lenders often want to see evidence of steady income when considering loan applications, and the concern over having a smaller income is its role in increasing your debt-to-income (DTI) ratio. DTI ratio, which you can calculate by dividing your monthly bill payments by your monthly income, is a measure lenders often consider (along with credit score, employment history and other assets you may have) when deciding whether to lend you money.

People often dial back credit usage as retirement approaches—mortgages may be paid off, cars accumulate fewer miles and get replaced less frequently, and household spending winds down as the nest empties—so odds are good the debt portion of your DTI ratio has shrunken. But unless you have zero debt, any drop in income will mean an increase in DTI ratio. Lenders typically look for DTI ratios below 43% when considering loan applications, so as long as you’re below that level, you probably don’t have much to worry about.

Why Credit Scores Still Matter When You’re Retired

Cutting back on borrowing as retirement nears is far from a universal situation (lots of retirees take out new mortgages on condos or vacation homes), and some retirees whose days of big-ticket financing are behind them make the mistake of concluding they can forget about their credit scores. But your credit scores can affect your finances even if you’re done applying for loans and credit cards. Here are a few ways low credit scores can cost retirees money:

Higher Interest Rates on Existing Debts

Many credit card issuers routinely monitor your credit scores for purposes known in the industry as “account management.” This practice gives card issuers a heads-up of changes in your creditworthiness, and many issuers reserve the right to change the terms of your cardholder agreement if your credit score declines significantly. They may lower your borrowing limit, increase the interest rate they charge or even close your account.

Lower Rates on Insurance

Auto and homeowners insurance companies often use information in your credit report to generate a type of specialized insurance score, which helps them decide what rates to charge you. Reductions in your credit score could mean higher insurance premiums.

Security Deposits

If you want to rent construction gear or other equipment for a DIY project, or if you just want to get a Wi-Fi router or DVR from the cable company serving your new retirement community, you’ll likely be subjected to a credit check. A fair to good credit score might not prevent you from getting the rental, but it might mean you’ll need to put down a higher security deposit than you would if your score were higher.

How to Keep Your Credit Score High During Retirement

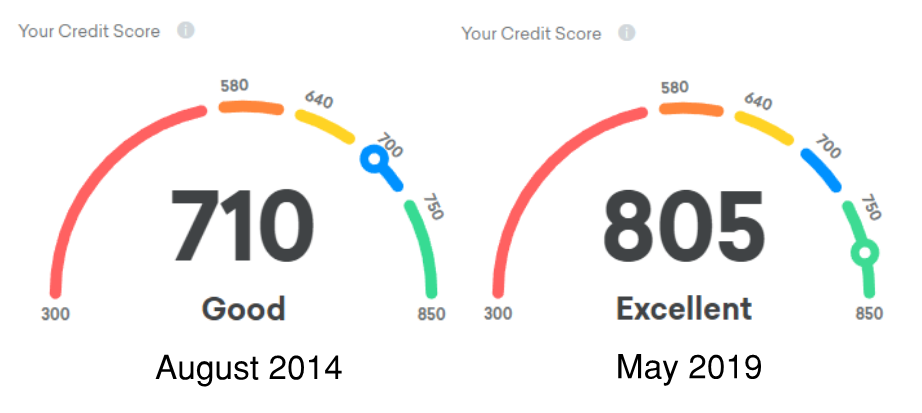

So how do you maintain a high credit score (or build up a score that could stand to be higher) once you’ve entered retirement? The same way you keep up your score at any other phase of life: Understand the factors that promote strong credit scores and avoid decisions that can bring your score down.

The most important steps you can take to avoid hurting your credit score are:

Pay Bills on Time

Do this every month without fail. If your retirement will include a lot of travel, or if you’ll be dividing time between two homes during the year, this may take some extra care. Schedule automatic payments for as many services as you can, and consider working with creditors, utilities and other vendors to keep all your payment due dates around the same time of the month to make it easier to organize your payments. Plus, you can get credit for paying cell phone and utility bills on time by adding these accounts to your Experian credit report. Once they’re in your report, your on-time payments may improve your credit history and increase your credit scores.

Avoid Excessive Credit Balances

Pay your credit card balances in full as often as possible (this also saves you from paying interest charges). When you must carry a balance from month to month, do your best to keep it below 30% of your borrowing limit. Experts agree that utilization rates in excess of 30% tend to lower your credit scores.

Resist the Urge to Close Older Credit Card Accounts

Even if you’re not using  the cards regularly, unless you’re paying fees for them, hang on to cards you’ve had a long time, particularly if you maintained a record of on-time payments for them. Why? Longstanding accounts help boost a credit scoring factor known as age of accounts.

the cards regularly, unless you’re paying fees for them, hang on to cards you’ve had a long time, particularly if you maintained a record of on-time payments for them. Why? Longstanding accounts help boost a credit scoring factor known as age of accounts.

Stay Active

It won’t mean any major credit score increase, but active credit card accounts—those you use regularly—tend to elevate credit scores slightly more than disused cards. So consider using an idle card to make a small payment each month—for your video streaming service, perhaps. If you set up an automatic payment through your checking account to pay the credit card bill, this will keep the card account active without adding to your monthly activity.

Be Vigilant

Identity thieves can wreak havoc on your credit by hijacking your credit cards or opening new cards in your name, and senior citizens and children are among the most frequent targets. Review all your bank and credit statements carefully each month, check your credit reports at least annually, and report any unauthorized activity immediately. Consider using a credit monitoring or identity protection service.

Retirement is the time to relax, savor your free time, and enjoy the fruits of your life’s labors and savings. Making just a little effort to keep up your credit scores can help ensure you have the flexibility to get the goods and services you want when you want them, make big or small purchases whenever the time is right, and pay for it all in whatever way is most convenient. You’ve earned that privilege.

Related Articles & Free Subscription

Related Articles & Free Subscription

Consider Some Year-end Investment Tax Moves

How to Make Your Money Last During Retirement

Comment here